Have you received a notice of a Social Security overpayment? It is not as uncommon as you may think.

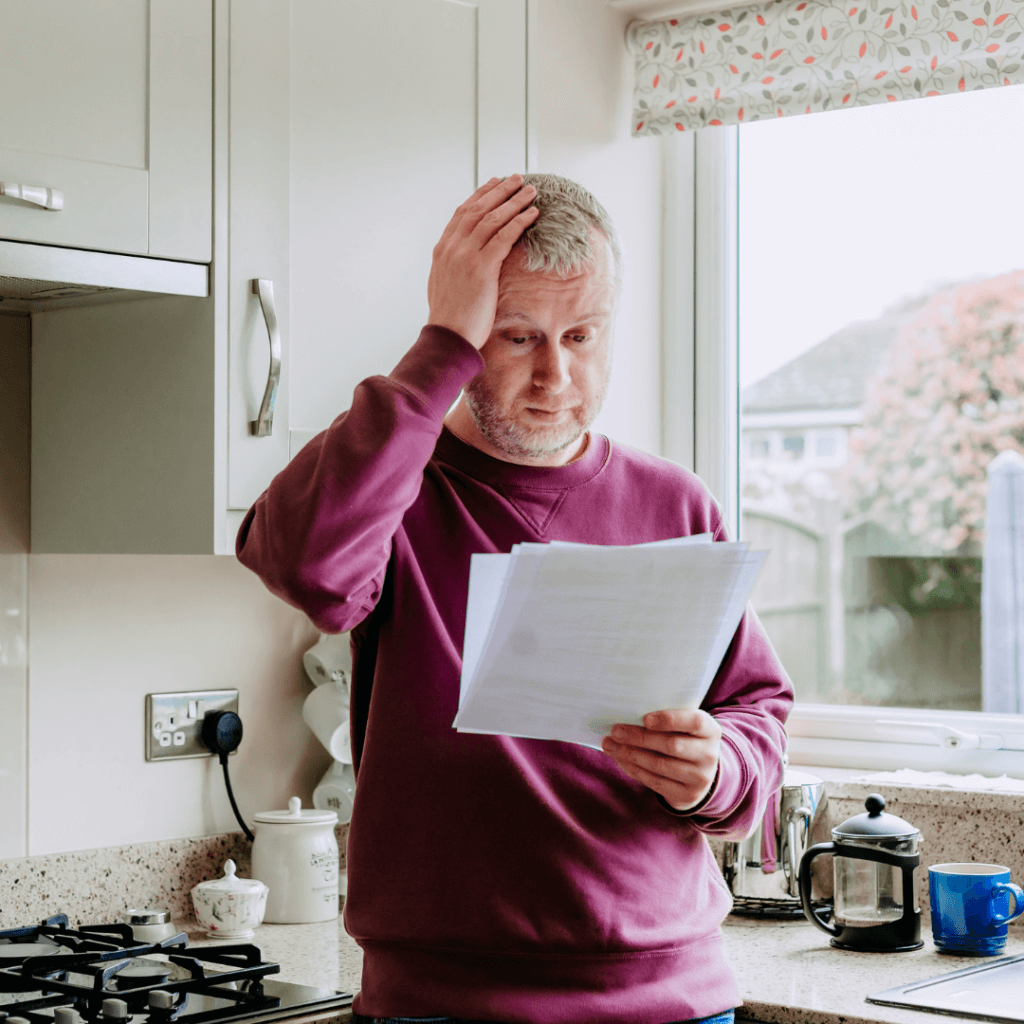

Receiving a bill from Social Security demanding repayment of overpaid benefits can turn your world upside down. You may even think it is a scam. Unfortunately, hundreds of thousands of Americans face this scenario, which causes financial strain and uncertainty.

For many, like those in Central Florida, the arrival of such notices marks the beginning of a daunting journey through a bureaucratic maze.

Understanding Social Security Overpayment

The Social Security overpayment process typically begins with a letter outlining the alleged overpayment, often stemming from reporting income or asset errors. These mistakes can lead to significant financial consequences, whether due to miscommunications or bureaucratic mishaps.

Even when Social Security’s data errors are to blame, beneficiaries often are told they are responsible for repayment.

Navigating the Overpayment Notice

Navigating the complexities of an overpayment notice from Social Security demands immediate attention and skilled guidance. If you have received a bill demanding repayment of overpaid benefits, it is crucial to act swiftly.

Social Security issues can be intricate, and errors in handling them can lead to significant financial repercussions. Seeking legal counsel promptly ensures that you understand your rights, can effectively challenge the overpayment decision if necessary, and navigate the appeals process with confidence.

Culbertson, Jacobs & LaBoda, PLLC specializes in Social Security Disability law and stands ready to provide the critical support and advocacy needed to protect your interests and minimize the impact of overpayment claims.

What To Do If You Receive A Notice Of SSDI Overpayment

When confronted with an overpayment of Social Security benefits notice, clarity, and decisive action are key:

- Understanding the Reason: Social Security details the overpayment amount and the reasons behind it. This information is crucial for formulating your response.

- Appealing the Decision: Beneficiaries can appeal the overpayment decision within a specified timeframe from the notice date. This process allows you to challenge errors or dispute the repayment requirement.

- Requesting a Waiver: If repaying the overpayment would cause undue financial hardship and you believe it was not your fault, you can request a waiver. Social Security evaluates these requests case by case.

- Negotiating Repayment: Social Security offers flexible repayment options if repayment cannot be waived. This payment arrangement can be tailored to your financial situation, often allowing minimal monthly installments.

- Seeking Legal Guidance: It is vital to speak with a Social Security Disability attorney immediately upon receiving a notice of overpayment from Social Security.

Our firm focuses on Social Security Disability law and can provide guidance and representation. Our attorneys can check the validity of the overpayment claim, navigate the appeals process on your behalf, and advocate for your rights to minimize or eliminate the repayment obligation.

Recognizing Legitimate Social Security Notices vs. Scams

Understanding how to differentiate between a legitimate Social Security notice and a scam is crucial for protecting yourself from fraud. Scammers often pose as SSA officials, using phone calls, emails, texts, or social media to pressure victims into revealing personal information or making payments. These fraudulent communications might appear convincing, featuring SSA logos and official-sounding language, but they often contain telltale signs like grammatical errors.

The SSA will never demand immediate payment, threaten legal action, or request personal details over the phone or via email. If you receive such a notice, it is vital to verify its legitimacy by contacting the SSA directly through official channels. By staying vigilant and informed, you can protect your personal and financial security from these deceptive schemes.

How Our Attorneys Are Helping Floridians

Attorneys Richard Culbertson and Sarah Jacobs actively assist Floridians with Social Security overpayment issues. Culbertson highlights the challenges clients face due to bureaucratic inefficiencies.

“The issue, most of the time, nobody answers the phone at the Social Security office to help you with your issue,” Culbertson points out. “There is something wrong with the management of Social Security. They just let all these things go, and if they won’t answer the phone and they won’t talk to us, then no one is dealing with these systemic problems.”

Sarah Jacobs, known for her commitment to clients, is deeply involved in assisting those who receive intimidating overpayment notices.

“They don’t comply with Social Security’s regulations, and it’s heart-wrenching when someone gets a letter saying you owe $30,000, send it to us in ten days. Otherwise, we’re holding your check going forward,” Jacobs said.

A local news organization continues to investigate these overpayment requests, and as lawyers suspect, the issue will get worse before it gets better. In the meantime, attorneys like Culbertson and Jacobs are working with Floridians to navigate their way through.

Contact Our Firm If You Have Received A Notice Of SSDI Overpayment

Receiving an overpayment notice from Social Security can be overwhelming, but understanding your rights and options is crucial. Whether you need to appeal, request a waiver, or negotiate repayment terms, Culbertson, Jacobs & LaBoda, PLLC is dedicated to helping you.

Contact us today if you have received an overpayment notice or have questions about Social Security Disability benefits.